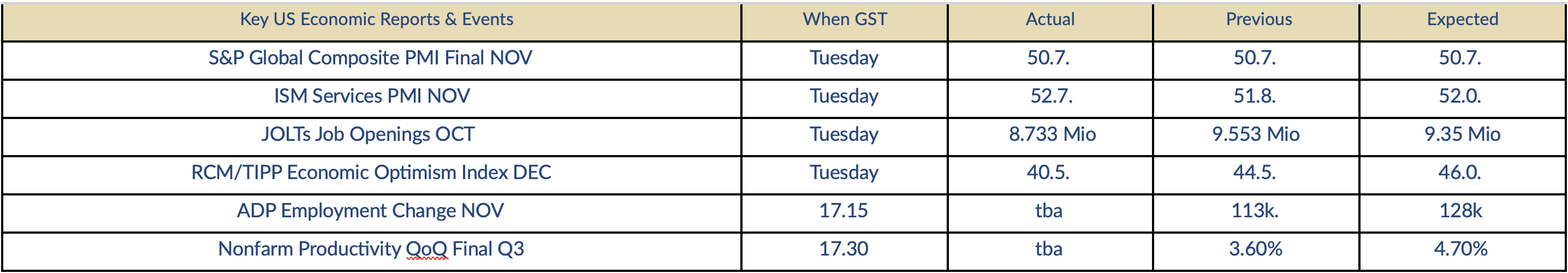

“Gold extends its reversal to technical support at $2010, expect a reduction in volatility”.

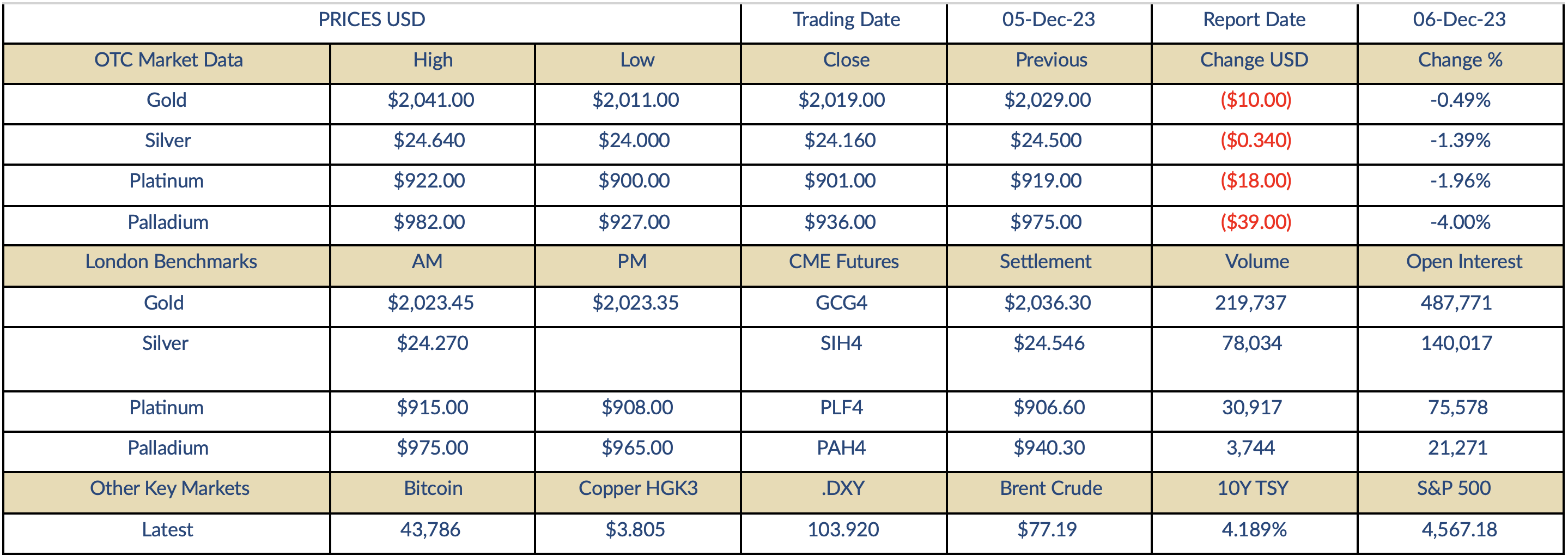

Indications only | Closing prices are bids | Prices & Charts : Trading View | Market Research Refinitiv | See disclaimer below

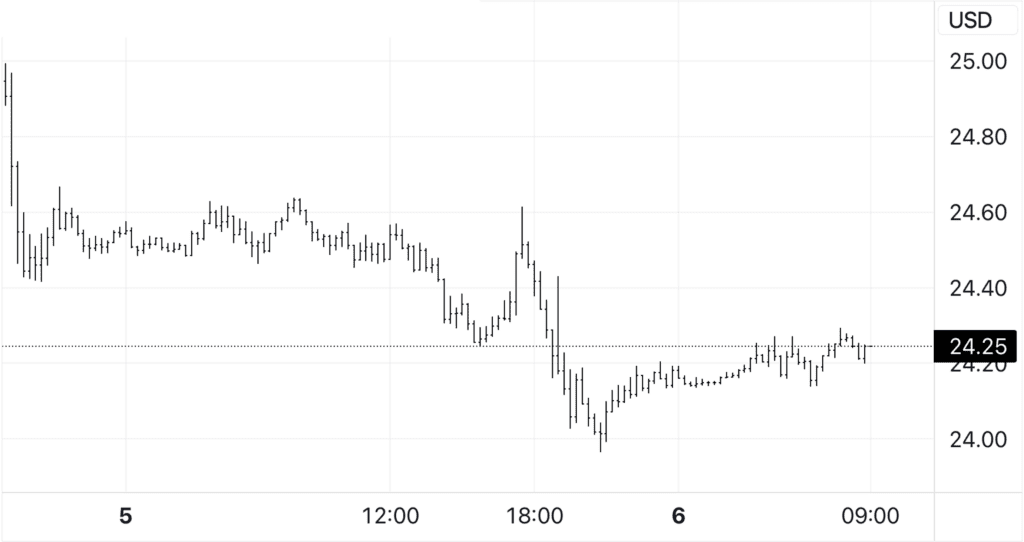

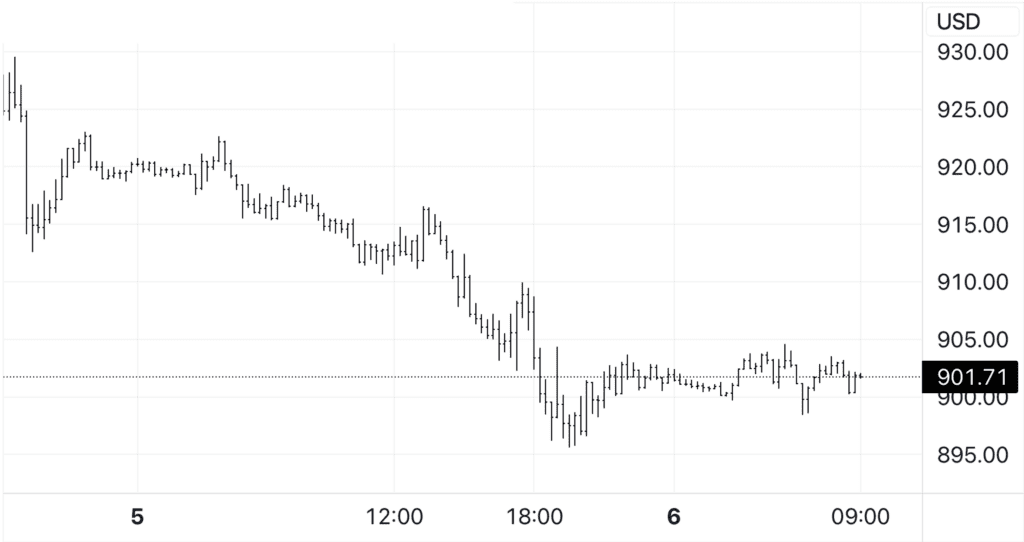

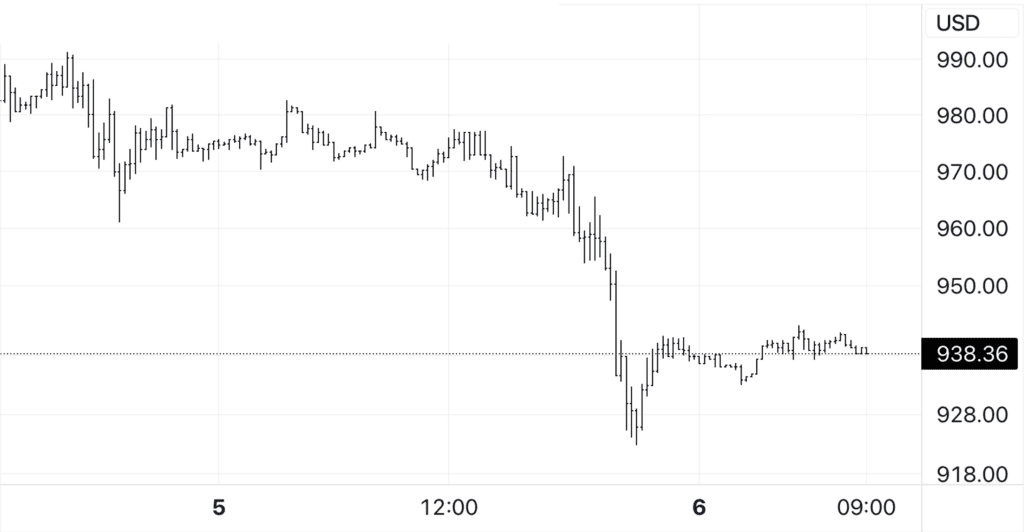

Thoughts for The Day: After posting a high of $2041 in early Asian trading on Tuesday, gold came under sustained selling pressure in Europe, falling to a low for the day of $2011 in New York as the USD firmed after a strong ISM Services PMI reading. However, this was countered by a weaker than expected job openings report to help the yellow metal recover to end with a pared 0.49% loss at $2019 and it has ranged between $2016 and $2024 so far today. After the carnage seen on Monday, the reduction in volatility yesterday came as a welcome relief to many and we now expect a couple of low-key sessions until the market picks up pace again on Friday with the release of the latest US non-Farm payrolls, that will bring the noise about a Fed rate cut in Q1 2024 back into play. The expected trading range today is 2010 to $2030. Silver added another 1.39% loss to Monday’s 3.81% decline, ending at $24.16, platinum fell 1.96% to $901, and palladium hit a fresh 5 year low of $927 before closing down 4.0% at $936.

Market Commentary: December 06, 2023, (source Reuters)

- Gold prices edged higher on Wednesday as the dollar eased, and weaker-than-expected U.S. jobs data cemented expectations that the Federal

Reserve’s policy tightening cycle has come to an end. Spot gold rose 0.2% at $2,023.39 per ounce by 0415 GMT. U.S. gold futures for February delivery also rose 0.2% to $2,041.00. “Volatility in gold prices is likely to remain capped heading into Friday’s U.S. non-farm payrolls data,” said City Index Senior Analyst Matt Simpson. “It might take a particularly weak set of numbers for gold to post strong gains from here – as many bullish fingers were likely burned with gold’s false break to a record high.”

- Bullion climbed to a record high of $2,135.40 on Monday on elevated bets for a Fed rate cut, before dropping more than $100 in the same session, on uncertainty over the timing of the monetary policy easing.

- Data on Tuesday showed U.S. job openings fell to a more than two-and-a-half year low in October, signalling that higher rates were dampening demand for workers.

- The dollar index DXY fell 0.1% against a basket of currencies after rising to a two-week high on Tuesday, making gold less expensive for other currency holders.

- Focus now shifts to the Friday release of the November non-farm payrolls data that could provide more clues on U.S. interest rate outlook ahead of Fed’s policy meeting next week. Traders are pricing in about a 60% chance of a rate cut by March next year, CME’s FedWatch Tool shows. Lower interest rates tend to support non-interest-bearing bullion.

- Spot gold may bounce into a range of $2,033-$2,039 per ounce, as it has stabilized around a support of $2,009, according to Reuters technical analyst Wang Tao.

- Silver rose 0.5% to $24.24 per ounce, while platinum gained 0.1% to $900.31. Palladium rose 0.6% to $940.14 per ounce, hovering near a more than five year low.

Economic Analysis (Trading Economics):

The number of job openings decreased by 617,000 from the previous month to 8.733 million in October 2023, marking the lowest level since March 2021 and falling below the market consensus of 9.3 million. During the month, job openings decreased in health care and social assistance (-236,000), finance and insurance (-168,000), and real estate and rental and leasing (-49,000). On the other hand, job openings increased in information (+39,000). Regarding regional distribution, job openings fell in the South (-289,000), the Midwest (-193,000), the West (-83,000) and the Northeast (-52,000). source: U.S. Bureau of Labor Statistics

Gold Chart

Silver Chart

Platinum Chart

Palladium Chart

This document is issued by Value Trading BV. While all reasonable care has been taken in preparing this document; no responsibility or liability is accepted for errors of fact or for any opinion expressed herein. Opinions, projections and estimates are subject to change without notice. This document is for information purposes only and for private circulation. It does not constitute any offer, recommendation or solicitation to any person to enter into transaction or adopt any hedging, trading or investment strategy, nor does it constitute any prediction of likely future movements in rates or prices or any representation that any such future movements will not exceed those shown in any illustration.