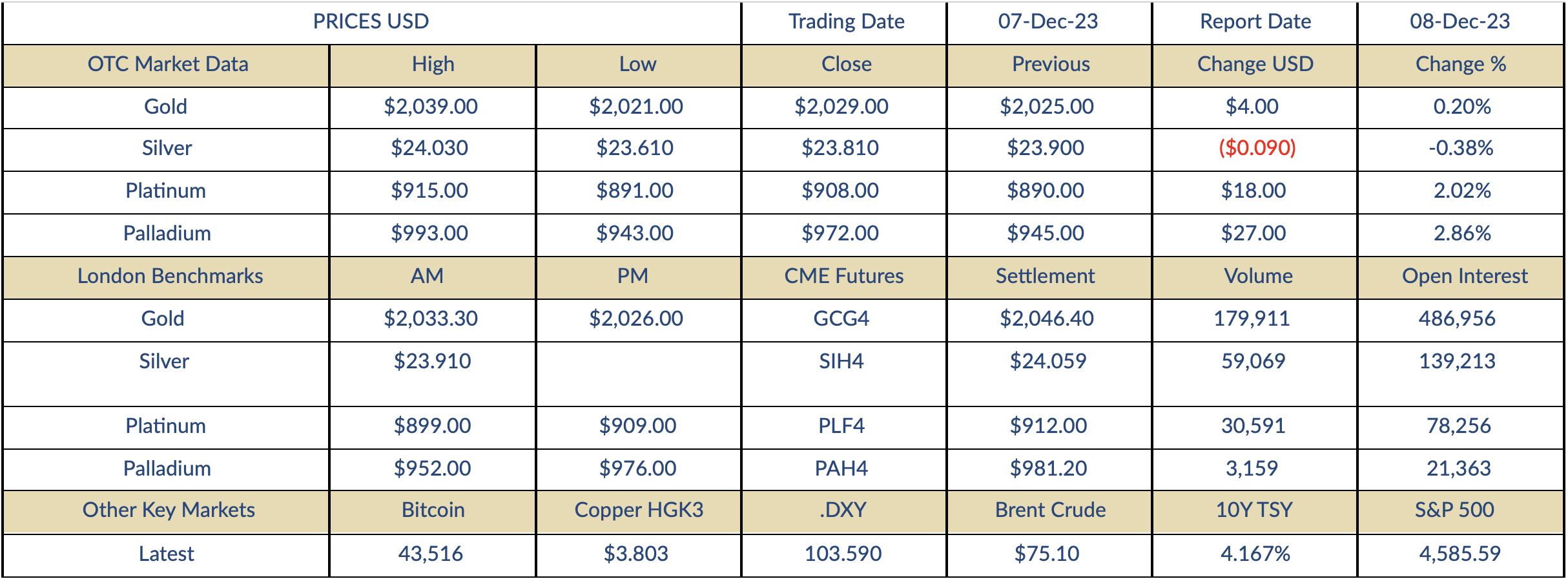

“Gold continues to consolidate; focus is on the US economy with the latest US jobs data”

Indications only | Closing prices are bids | Prices & Charts : Trading View | Market Research Refinitiv | See disclaimer below

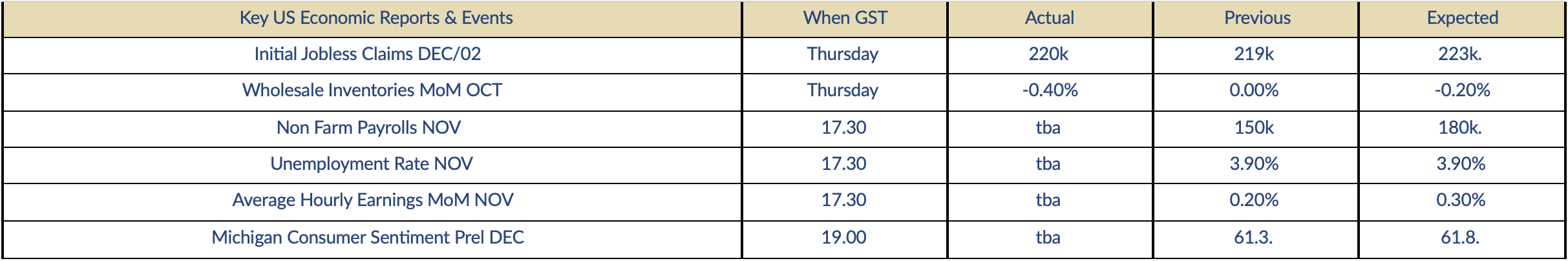

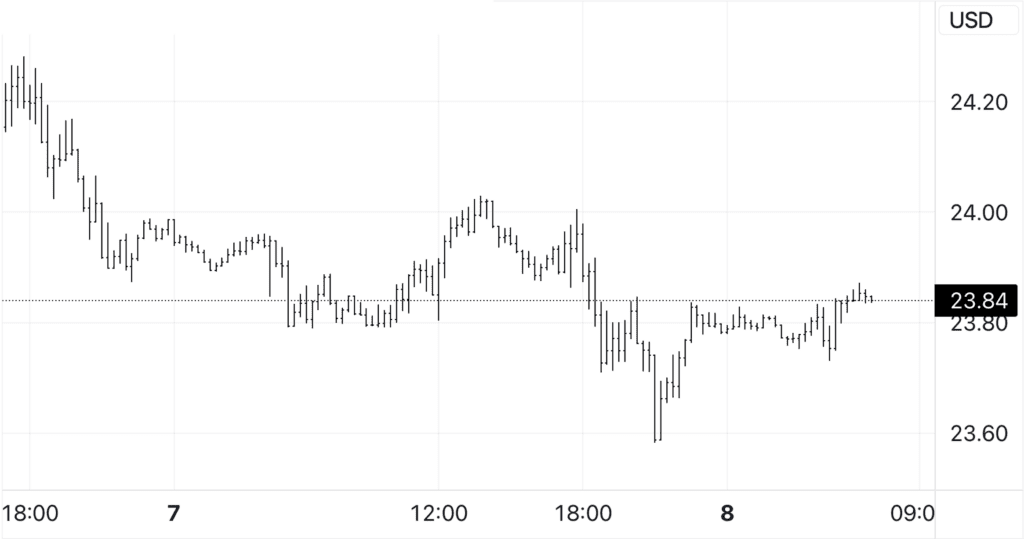

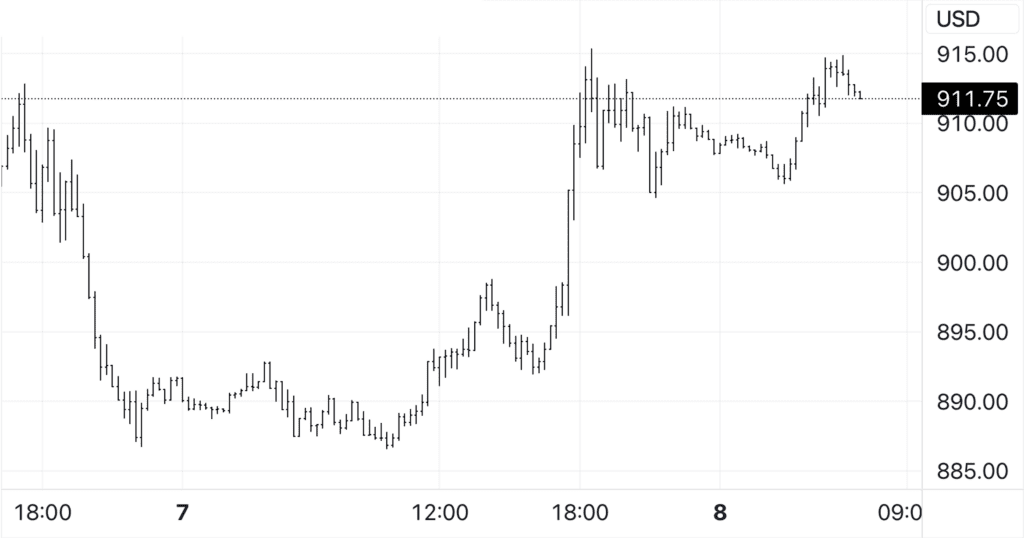

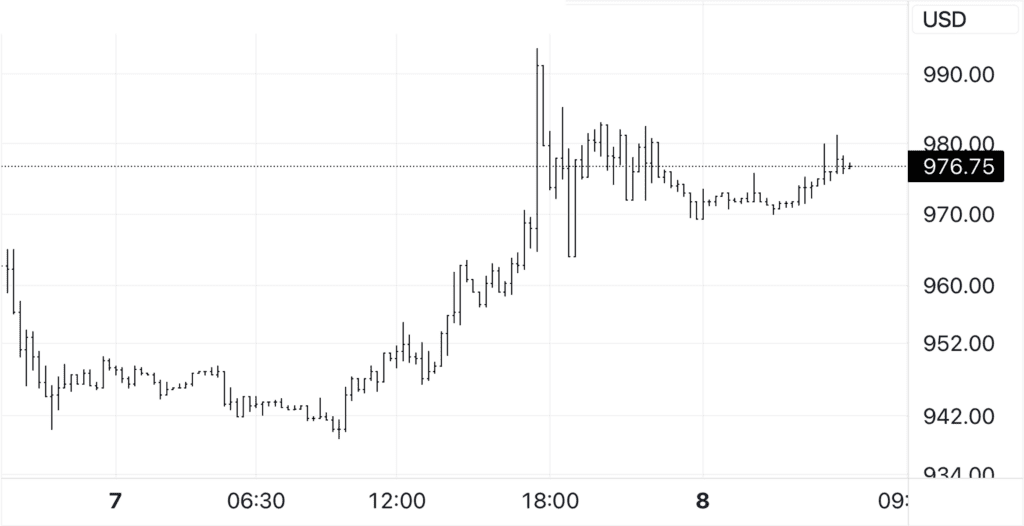

Thoughts for The Day: Gold traded narrowly between $2025 and $2032 in Asia and Europe on Thursday as the market continued to consolidate after the extreme price volatility seen at the start of the week, but this was a prelude to a more active session in New York with the price rallying to a high for the day of $2039 before slumping to a low of $2021 on moderate trading volume. The yellow metal recovered into the close to end with a marginal 0.2% gain at $2029 and has held in a tight $2028 to $2034 range so far today, however we expect a volatile end to a record breaking week with a potential trading range of $2015 to $2045 as the focus turns to the US economy with the release of the latest US employment data, an economic indicator closely watched by the Fed when determining its monetary policy. Silver eased 0.38% to $23.81, however the PGM’s had a good day with platinum gaining 2.02% to (08, and palladium adding 2,86% to $972.

Market Commentary: December 08, 2023, (source Reuters)

- Gold prices were set to mark their first weekly fall in four after the dollar firmed, but traded steadily on Friday as investors stayed cautious ahead of key jobs print due later in the day to gauge the potential for U.S. rate cuts by March. Spot gold edged up 0.2% to $2,032.36 by 0215 GMT. Bullion, however, fell 1.8% for the week so far. U.S. gold futures edged 0.1% higher to $2,048.80. Bullion scaled an all-time peak of $2,135.40 on Monday on elevated bets for a cut by the U.S. Federal Reserve, before dropping more than $100 on uncertainty over the cut’s timing.

- The dollar index DXY was on track to snap three straight weeks of losses. A stronger dollar makes greenback-priced gold more expensive for other currency holders.

- Yields on benchmark 10-year Treasury notes US10Y slipped this week but retreated from a three-month low on Friday.

- Data this week suggested that the U.S. labor market was gradually losing momentum as higher borrowing costs curb demand in the broader economy.

- After an uptick in weekly U.S. jobless claims, traders positioned for the non-farm payrolls data due at 1330 GMT. Traders were pricing a 65% chance of a rate cut by March next year, CME’s FedWatch Tool showed, but a Reuters poll saw rates unchanged until at least July. Lower interest rates tend to support non-interest-bearing bullion.

- The yen extended its towering rally against the dollar, as traders ramped up expectations that the end of Japan’s ultra-low interest rates was closing in.

- Spot silver rose 0.2% to $23.83 per ounce, while platinum gained 0.6% to $912.31, and palladium inched 0.5% higher to $974.25 per ounce.

Economic Analysis (Trading Economics):

The number of Americans filing for unemployment benefits edged higher by 1,000 to 220,000 on the week ending December 2nd, slightly under market expectations of 222,000, but marking the second-highest reading since September. The result extended the current trend that the US labor market is showing signs of cooling from tighter levels displayed earlier in the year, albeit remaining strong from a historical standpoint. The four-week moving average, which removes week-to-week volatility, rose by 500 to 220,750. The non-seasonally adjusted claim count jumped by 93,761 to 293,511, amid sharp increases in California (+14,057), New York (+9,343), and Texas (+7,698). On the other hand, continuing claims sank by 64,000 to 1,861,000 in the earlier week, pointing to an improvement in conditions for the unemployed to find available positions. Source: U.S. Department of Labor

Gold Chart

Silver Chart

Platinum Chart

Palladium Chart

This document is issued by Value Trading BV. While all reasonable care has been taken in preparing this document; no responsibility or liability is accepted for errors of fact or for any opinion expressed herein. Opinions, projections and estimates are subject to change without notice. This document is for information purposes only and for private circulation. It does not constitute any offer, recommendation or solicitation to any person to enter into transaction or adopt any hedging, trading or investment strategy, nor does it constitute any prediction of likely future movements in rates or prices or any representation that any such future movements will not exceed those shown in any illustration.