“Gold stabilises after Monday’s carnage, expect sideways trading ahead Friday’s jobs data”

Indications only | Closing prices are bids | Prices & Charts : Trading View | Market Research Refinitiv | See disclaimer below

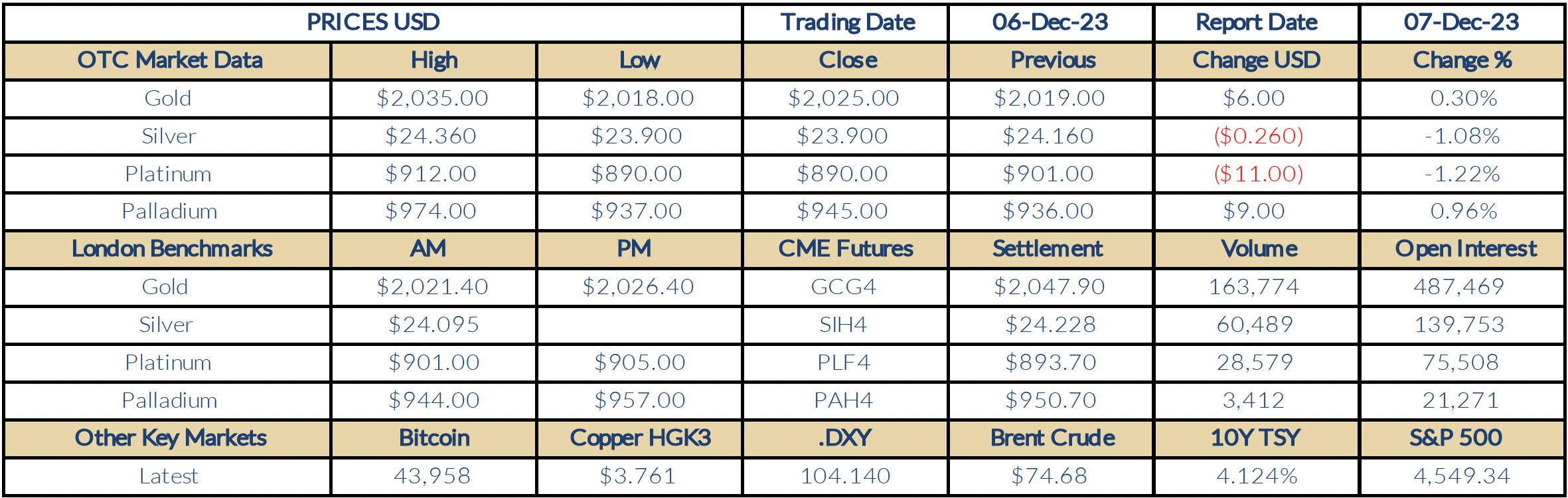

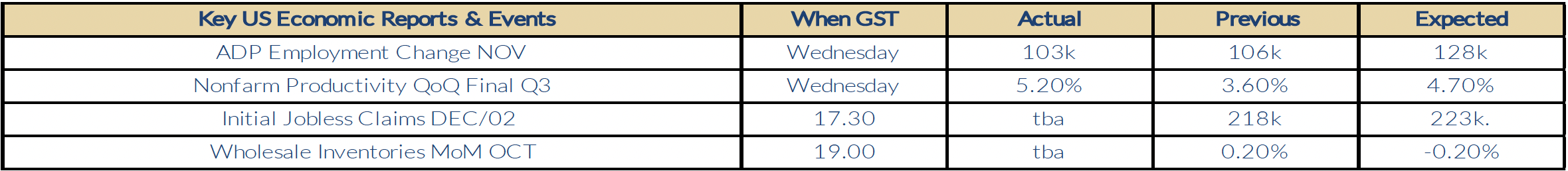

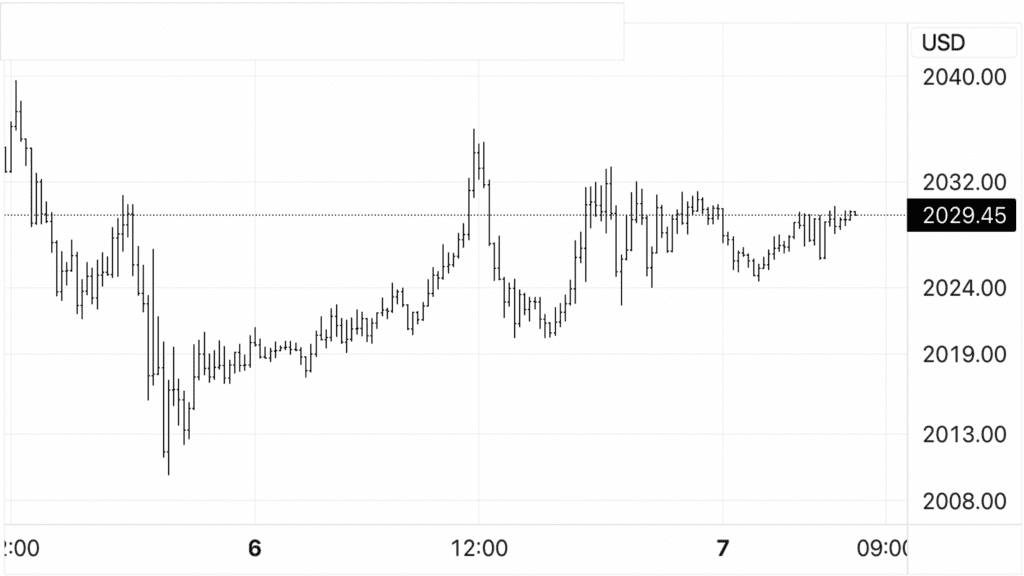

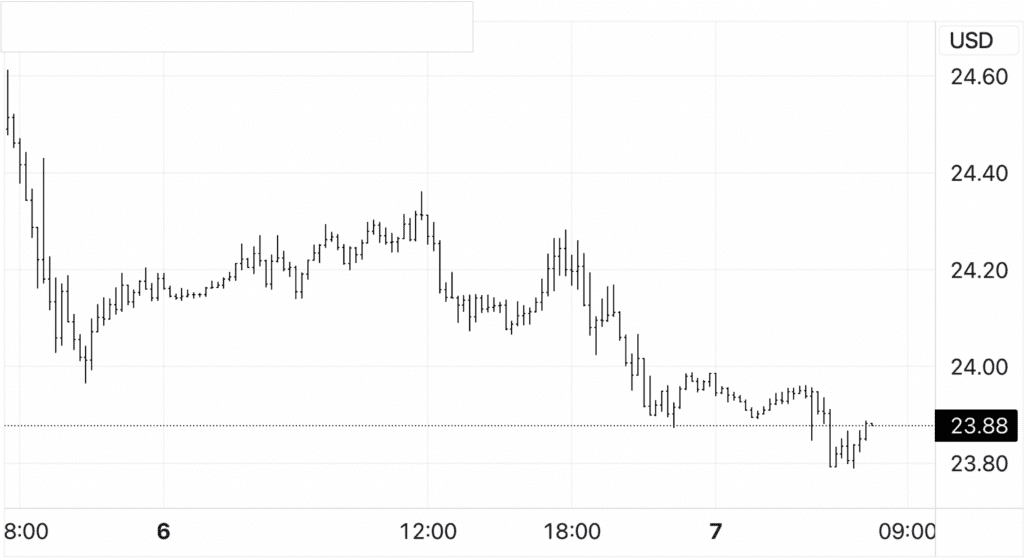

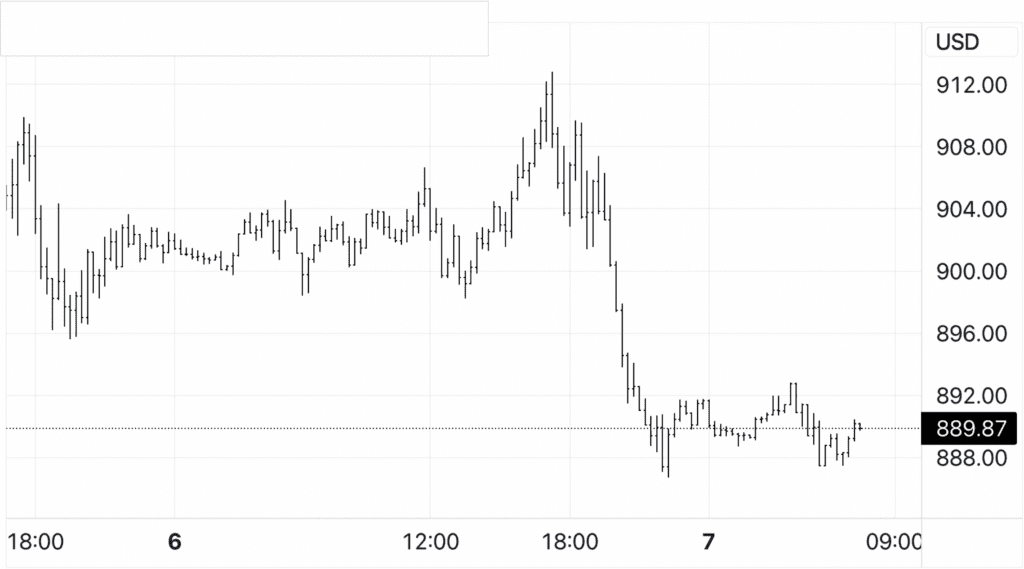

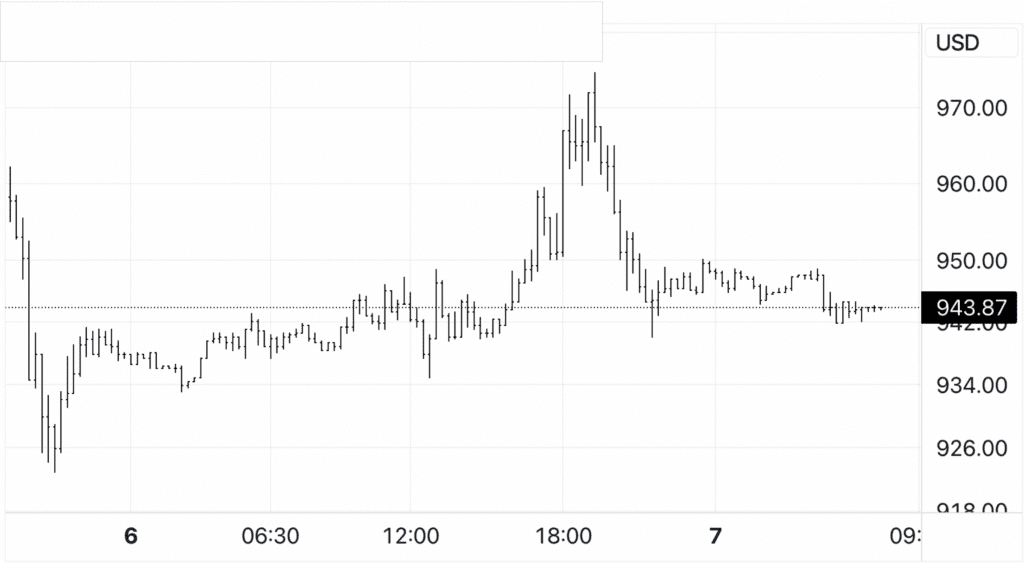

Thoughts for The Day: Gold stabilised after the carnage witnessed at the start of the week, posting an early low for the day of $2018 in Asia on Wednesday and then working its way steadily higher to reach $2035 shortly after the European opening. Fresh selling emerged to push the price back to $2021.40 at the AM benchmark in London and this was followed by a period of sideways trading between $2022 and $2032 before ending with a modest o.3% gain at $2025. The yellow metal has held between $2024 and $2030 so far this morning and we are expecting another day of consolidation within a trading range of $2015 and $2035 ahead of tomorrow’s closely watched US employment data that could spark renewed price volatility and set the tone for the rest of the month. Silver extended its decline into a third session, ending down 1.08% at $23.90 as it tracked copper lower; platinum had another disappointing day, ending on the lows and down 1.22% at $890, while palladium staged a modest bounce to end up 0.96% at $945.

Market Commentary: December 07, 2023, (source Reuters)

- Gold prices rose on Thursday, as signs of a cooling U.S. labour market supported bets of an interest rate cut early next year, while traders also awaited key jobs print due later in the day that could offer clues on the Federal Reserve’s trajectory. Spot gold was up 0.1% at $2,027.12 per ounce by 0159 GMT. U.S. gold futures fell 0.2% to $2,044.10.

- The dollar index DXY dipped 0.1% against a basket of currencies, making gold less expensive for other currency holders.

- Yields on 10-year Treasury notes hovered near a three-month low. U.S. job openings fell to a 2-1/2-year low in October, and U.S. private payrolls increased less than expected last month, signalling a gradual cooling of the labor market.

- Other data on Wednesday showed that U.S. unit labor costs were much weaker than initially thought in the third quarter amid robust worker productivity. Lower interest rates tend to support non-interest-bearing bullion.

- Investors now await key U.S. non-farm payrolls data on Friday, which could help further gauge the rate outlook, ahead of the Fed’s updated economic and interest rate projections at their Dec. 12-13 policy meeting. Traders are pricing in about a 60% chance of a rate cut by March next year, CME’s FedWatch Tool shows.

- The Bank of Canada on Wednesday held its key overnight rate at 5% and left the door open to another hike.

- Spot silver fell 0.4% to $23.79 per ounce, while platinum dropped 0.3% to $887.40, and palladium edged 0.1% lower to $942.40 per ounce.

Economic Analysis (Trading Economics):

- Private businesses in the US hired 103K workers in November 2023, below a downwardly revised 106K in October and expectations of 130K. The services sector added 117K jobs, led by trade, transportation & utilities (55K); education & health (44K); financial activities (11K) and information (4K), job losses occurred in leisure and hospitality (-7K) and professional/business services (-5K). Meanwhile, the goods sector shed 14K jobs, due to manufacturing (-15K) and construction (-4K). Meanwhile, pay growth continued to slow with job-stayers seeing a 5.6% pay increase, the smallest since September 2021. Job-changers saw pay gains of 8.3%, the least since June 2021. source: Automatic Data Processing, Inc

- Nonfarm business sector labor productivity advanced by 5.2% in the third quarter of 2023, accelerating from 3.6% rise in Q3 and more than preliminary estimates of a 4.7% increase. The increase in labor productivity is the highest rate since the third quarter of 2020, in which productivity increased 5.7 percent. Output grew by 6.1% (vs 5.9% in the preliminary) while hours worked were up by 1.1% (vs 0.9%). From the same quarter a year ago, nonfarm business sector labor productivity increased by 2.4%, also above earlier estimates of 2.2%. source: U.S. Bureau of Labor Statistics.

Gold Chart

Silver Chart

Platinum Chart

Palladium Chart

This document is issued by Value Trading BV. While all reasonable care has been taken in preparing this document; no responsibility or liability is accepted for errors of fact or for any opinion expressed herein. Opinions, projections and estimates are subject to change without notice. This document is for information purposes only and for private circulation. It does not constitute any offer, recommendation or solicitation to any person to enter into transaction or adopt any hedging, trading or investment strategy, nor does it constitute any prediction of likely future movements in rates or prices or any representation that any such future movements will not exceed those shown in any illustration.